Markets surge after Trump's sudden tech tariff reversal as Commerce Secretary warns exemption is "not permanent" - $6 trillion already wiped from markets

Wall Street is breathing a temporary sigh of relief after a stunning weekend policy reversal.

Markets Rebound After Weeks of Chaos

Futures markets showed immediate positive reaction Sunday evening, with tech-heavy Nasdaq leading the charge at a 1.26% gain.

The S&P 500 futures rose 0.75%, while Dow futures added 212 points or 0.5% as of 6:18 pm ET.

This upswing comes after what can only be described as market whiplash over the past two weeks.

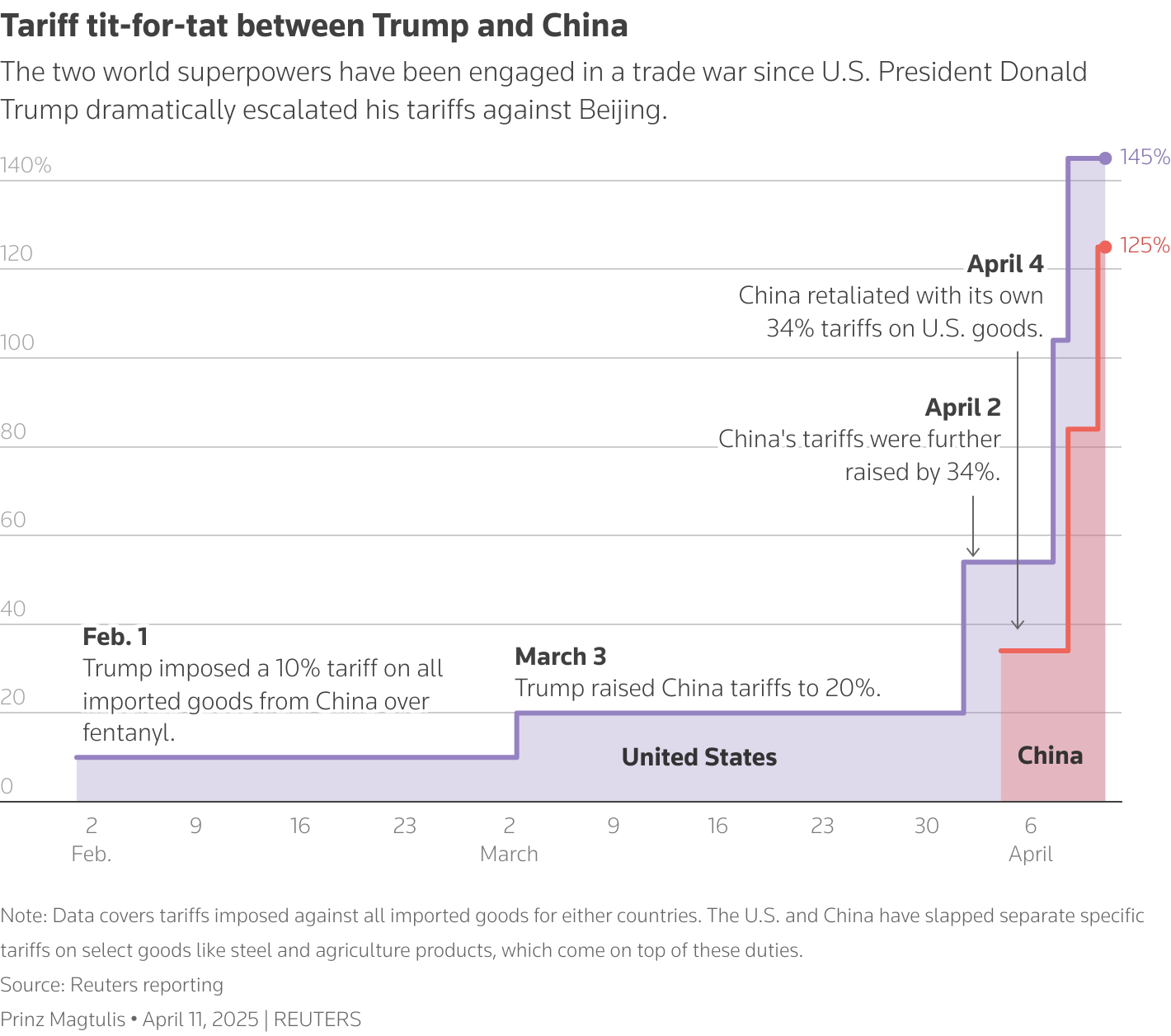

The Tariff Rollercoaster

Since early April, markets have been on a wild ride as the Trump administration unveiled a series of sweeping tariff announcements.

The initial implementation included a baseline 10% tariff on imports from all countries, with significantly higher rates targeting what the administration called "worst offenders."

Cambodia faced a staggering 49% tariff, Vietnam 46%, and European Union goods were hit with 20%.

China, long in Trump's crosshairs on trade issues, was subjected to a hefty 20% tariff on all goods.

Tech Giants in the Crossfire

The tariff situation created particular anxiety for American tech companies with significant manufacturing presence in China.

Apple, Microsoft, and Nvidia all rely heavily on Chinese manufacturing for their consumer products.

The prospect of 20% tariffs on iPhones, computers, and semiconductor components sent shockwaves through boardrooms and trading floors alike.

Investors will not invest in the United States when Donald Trump is playing 'red light, green light' with tariffs and saying, 'Oh, and for my special donors, you get a special exemption.'

That scathing assessment came from Massachusetts Senator Elizabeth Warren during an appearance on CNN's "State of the Union."

The Weekend Surprise

Late Friday, with little advance warning, the Trump administration announced a significant exemption.

Electronic imports would be spared from the reciprocal tariffs – a move that immediately boosted sentiment for tech stocks.

The exemption covers computers, phones, and semiconductors – though importantly, these items would still face the baseline 20% tariff if manufactured in China specifically.

The market response was swift and positive, especially for tech companies that had seen their valuations plummet in recent sessions.

The $6 Trillion Question

The tariff chaos has already extracted a devastating toll on financial markets.

In just the first two days following the initial April 3rd tariff announcement, nearly $6 trillion in market value was erased.

The volatility continued through April 7th as investors struggled to interpret the rapidly changing trade policies.

This weekend's exemption announcement offers a reprieve, but questions remain about how long it will last.

The Fine Print

Despite the market optimism, Commerce Secretary Howard Lutnick delivered a sobering message on Sunday that the tech exemption was "not permanent."

Other administration officials hinted at the possibility of new tariffs following an investigation into the national security implications of semiconductor imports.

President Trump himself took to Truth Social to address concerns that he was softening his stance.

NOBODY is getting 'off the hook' for the unfair Trade Balances, and Non Monetary Tariff Barriers, that other Countries have used against us, especially not China which, by far, treats us the worst!

The mixed messaging has left investors, manufacturers, and retailers in a state of prolonged uncertainty.

Many businesses report they're delaying major investment decisions until they receive clarity on the administration's long-term trade strategy.

With billions of dollars at stake and consumer prices hanging in the balance, this temporary tech exemption offers a moment of relief – but the market rollercoaster appears far from over.