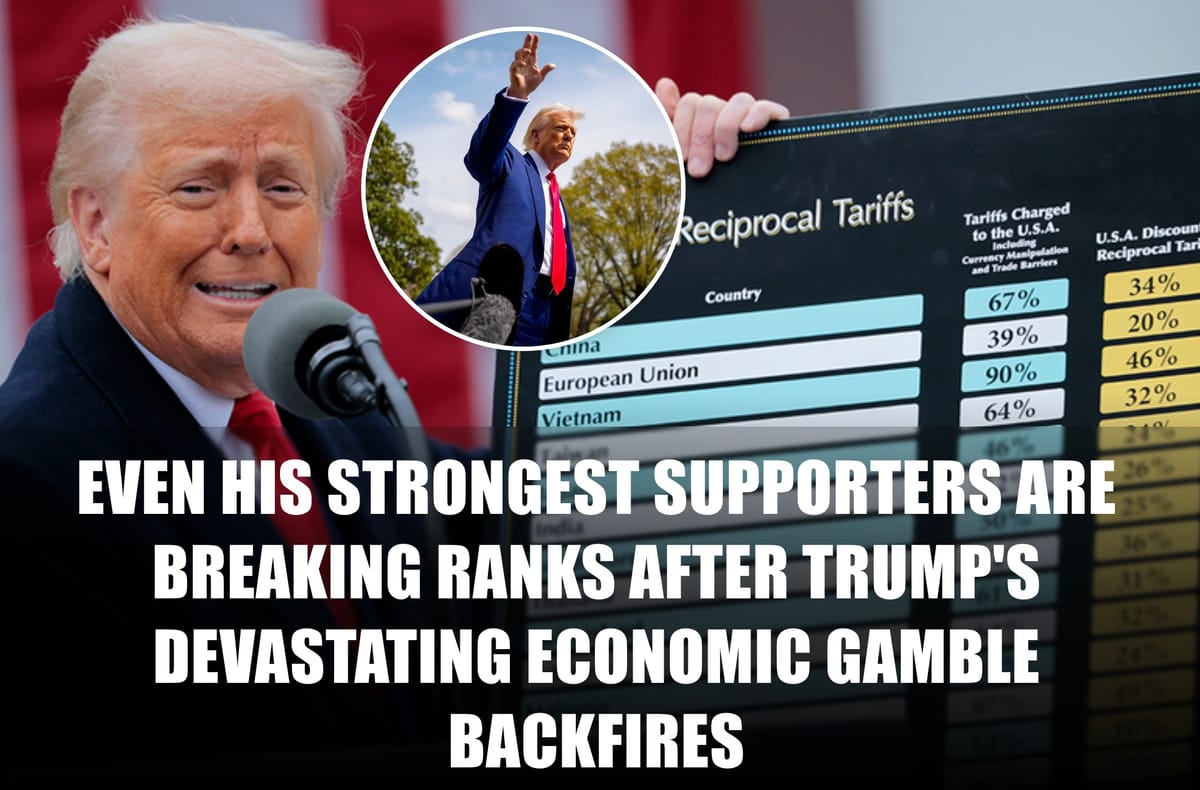

Even His Strongest Supporters Are Breaking Ranks After Trump's Devastating Economic Gamble Backfires

Trump's Tariff Chaos Cost Americans $11 Trillion In One Week

If you've been feeling financial whiplash over the last week, you're not alone. The economic rollercoaster engineered by former President Trump's tariff announcements — and subsequent partial reversal — has left markets, businesses, and everyday Americans stunned.

Just one week after announcing sweeping "reciprocal" tariffs that sent global markets into a tailspin, Trump abruptly changed course Wednesday by pausing most of these taxes for 90 days. The announcement came after markets had already lost an estimated $11 trillion in value — the equivalent of half the entire U.S. annual GDP.

"It took great courage for him to stay the course until this moment," Treasury Secretary Scott Bessent told reporters, adding: "This was his strategy all along."

This statement came just one day after White House Press Secretary Karoline Leavitt had boasted about Trump's "spine of steel" regarding the tariffs, raising serious questions about whether there was any coherent strategy at all.

The economic chaos over the past week has been unprecedented in modern times. Trump's initial announcement raised the average U.S. tariff rate to its highest level since 1909 and represented what many economists called the largest effective tax hike on American families in over 70 years.

What makes this situation truly remarkable is that even Trump's most loyal supporters began breaking ranks over the tariffs.

"I love President Trump," Senator Ted Cruz declared on his podcast. "I am his strongest supporter in the Senate. I think he's doing incredible things as President. But here's one thing to understand: A tariff is a tax, and it is a tax principally on American consumers."

The human toll of this economic experiment has been felt across industries. Manufacturing companies that rely on imported parts were thrown into crisis planning mode, farmers worried about retaliatory tariffs from countries like China, and millions of Americans watched their retirement accounts plummet.

While markets rebounded somewhat on news of the pause, the 90-day timeline creates a new problem: extended uncertainty. Businesses now must prepare for two entirely different economic scenarios after the pause expires, making long-term planning nearly impossible.

"The problem is that it isn't yet clear to anyone—most importantly, the countries trying to negotiate off ramps—what an acceptable deal would look like," said Brad Setser, who served in the Obama-era Treasury Department.

When asked if falling bond markets influenced his decision to partially reverse course, Trump offered a puzzling response: "The bond market right now is beautiful. But I saw last night where people were getting a little queasy."

Meanwhile, the White House's claims that the tariff threats have brought dozens of countries to the negotiating table raise an uncomfortable question: If generating leverage for trade talks was the goal all along, was it necessary to erase trillions in market value to achieve it?

For millions of Americans whose financial security was shaken by the past week's events, the answer seems clear. As one Senate Finance Committee member put it during a heated exchange with Trump's trade representative: "Sir, you are a much smarter person than that answer."

With 90 days on the clock before the tariff question resurfaces, both Wall Street and Main Street are left wondering: was this a strategic pause or simply the latest chapter in an unpredictable economic saga with no clear endgame?